Are you a Texas resident who is trying to understand the differences between living trusts and wills? If so, look no further! While both are key components of any estate plan, understanding how they differ can be an essential part of ensuring that your wishes are met upon death. With this in mind, I’d like to take some time to highlight the similarities as well as the unique distinctions between living trusts and wills in Texas.

Whether you’re starting a new family or looking forward to retirement, these documents can help ensure you provide for loved ones even after your passing. We’ll cover typical drafting considerations along with potential tax consequences and more, so get ready — here’s everything you need to know about Living Trusts vs Will In Texas!

What is a Living Trust and why it’s important in Texas

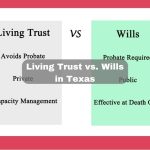

Living Trusts vs Wills

A Living Trust is an important estate planning tool available to Texans that allows individuals to control the use and distribution of their assets upon their passing. Unlike a will, a Living Trust can save loved ones from the lengthy and expensive probate process.

A Living Trust is an important estate planning tool available to Texans that allows individuals to control the use and distribution of their assets upon their passing. Unlike a will, a Living Trust can save loved ones from the lengthy and expensive probate process.

A Living Trust also offers more privacy than a Will and can be amended or revoked whenever necessary. Of course, no one wants to think about the end of life, but for Texans, it’s essential to be prepared for all eventualities. Creating a Living Trust helps ensure that your wishes are seen through by protecting your property and providing financially for those you care about even after you’re gone.

Exploring the differences between a Living Trust vs Will In Texas

Coming to terms with the reality of mortality can be one of life’s most difficult obstacles to face, and for Texans who want to protect their loved ones, a Living Trust or Will is essential. However, these documents offer different benefits which should be explored in detail when determining which is right for an individual situation.

In Texas, when creating a will the testator must sign the document in front of two witnesses, while a Living Trust remains private and is often used to transfer assets without going through probate court. Furthermore, only a legal professional can create a Living Trust as anyone over 18 may draft up their own Will. These are just some of the differences between these two estate planning documents that must be considered while creating your legacy in Texas.

Benefits of a Living Trust in Texas

If you live in Texas, a Living Trust can provide you with an array of benefits that other estate planning documents cannot. Firstly, it allows you to avoid the probate process which can be long and costly. It also preserves your family’s privacy since it is not a public record like a Will is.

Additionally, a Living Trust provides more flexibility to control when beneficiaries receive their inheritances than a Will does. By having this unique document in place for your family, any grief and stress along with conflicting interests within the family are reduced because everyone knows what to expect.

Having a Living Trust in Texas is ultimately the best decision for protecting your assets and providing financial security to those you care about.

Pros of a Living Trust

- A living trust will let you avoid going to probate.

- A living trust offers more privacy than a Will.

- A living trust offers more flexibility regarding beneficiaries than a Will.

Reasons to consider creating a Will in Texas

If you are a Texas resident, establishing a will is an important step in the estate planning process. Having a will in place offers many benefits, including giving you peace of mind that your wishes will be carried out should something happen to you. It also lets you designate who will act as guardian for any minor children, allows you to choose an executor who can handle the legal aspects of settling your estate, and enables you to provide specific instructions regarding your assets and debts without having to rely on state laws.

Furthermore, creating a will rather than relying on a living trust can help to reduce administrative costs and fees associated with settling your estate. With the right guidance and advice from an experienced Texas attorney, you can plan confidently and secure your legacy for those who matter most to you.

Understanding the process of creating a Living Trust or Will in Texas

For Texas residents looking to create their estate plan, two of the most common options are a Living Trust or Will. It’s important to understand the differences between these two documents and how they can potentially benefit you and your loved ones when the time comes.

At my law firm, I can help walk you through each option step-by-step so that you understand exactly what you are signing up for. We take great care in understanding your personal wishes and desired outcomes to ensure that all paperwork is completed properly, without missing any key details. Allow us to provide the peace of mind your family deserves by providing legal assistance with creating a Living Trust or Will in Texas.

Trusts & Estate Lawyer in Texas

As you consider either a Living Trust or a Will in Texas, it is important to know the differences between them and understand which is right for your situation. When seeking advice on which option to pursue, there are certain questions to ask. These include exploring the ways in which property will be distributed, who acts as trustee and/or executor, the potential for tax savings, costs associated with creating the trust or will, and any other unique needs for your specific set of circumstances.

Additionally, you will want to ensure that all state regulations are observed and that any required paperwork is properly prepared. By asking these questions early on in the estate planning process you can gain a better understanding of how choosing one option over another may affect your beneficiaries and assets now and in years to come.

To conclude, establishing a Living Trust or Will in Texas is an important process for many individuals throughout this great state. There are many reasons and benefits to consider when creating a Living Trust or Will, but ultimately, the decision is yours.

You should take the time to look into all your options, ask questions of qualified professionals, and determine what course of action best meets your needs. Whether you choose to create a Living Trust or Will in Texas, rest assured that you will be equipped with the information and requirements necessary to make the right decision for yourself and your family. It’s never too late or too early to consider these important provisions – but don’t forget it’s always best to be prepared!